The United States has been experiencing a decline in the quality of life for many years. This is due to the increase in entitlement programs, which have led to an unsustainable debt load.

The american entitlement is a term that has been used to describe the many ways in which the United States has failed to live up to its potential.

Democrats are rushing to find a reason, any argument, to persuade a sceptical public to support their $5 trillion spending proposal. President Biden’s most recent, and most surprising, effort is to pretend that all of his new entitlements would, well, make America better.

Mr. Biden said Tuesday that opposing these expenditures “is to be complicit in America’s decline,” adding that “other nations are racing ahead while America is lagging behind.” Senators Joe Manchin and Kyrsten Sinema, did you get that? You’re a part of the country’s impending doom.

***

You have to appreciate the boldness of proposing more taxes and more social assistance as a route to national rebirth, particularly when the evidence from across the world suggests otherwise. Mr. Biden’s increased benefits are likely to decrease incentives to work and invest, resulting in slower economic growth, lower living standards, and less budgetary room for critical public goods like as national security.

That’s the lesson to be learned from Europe’s cradle-to-grave welfare states, which Bernie Sanders promotes as role models. Although they have older populations than the United States, this does not explain why they have lower labor participation rates and structural unemployment. European unemployment rates, particularly among the young, are considerably higher than in the United States. In 2019, 62.6 percent of Americans were employed, compared to 49.7% in Italy, 55 percent in France, 57.7% in Spain, 59.3% in Portugal, and 61.3 percent in Germany.

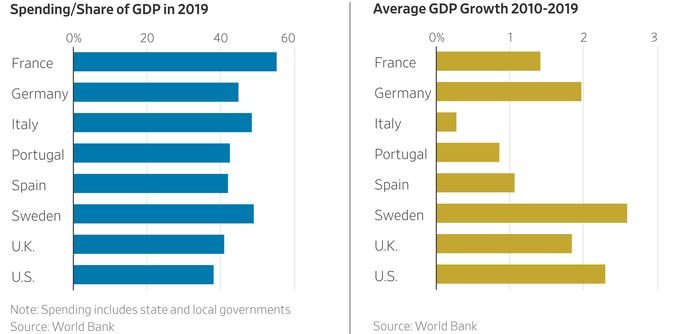

Slower growth has been attributed to Europe’s lower workforce participation rates. Despite the fact that the US economy took longer than expected to recover from the 2008-09 recession due to Obama policy uncertainty, GDP growth in the US averaged 2.3 percent from 2010 to 2019, outpacing Italy (0.27 percent), Portugal (0.86 percent), Spain (1.07 percent), France (1.42 percent), and Germany (0.27 percent) (1.97 percent ).

More generous family leave, according to Democrats, would encourage more women to work and grow the workforce. However, Italy provides 22 weeks of paid maternity leave at 80% of prior wages. France offers 16 weeks at 90%, while Spain offers 16 weeks at 100%. Instead of increasing the motivation to recruit, higher payroll taxes to provide these lavish benefits have decreased it.

The middle class pays for Europe’s cradle-to-grave welfare states via value-added and payroll taxes, which is a little-known secret. In Spain, the combined employer-employee social security tax rate is 36 percent, in Italy it is 40 percent, and in France it is 65 percent. In most European countries, value-added taxes are about 20%. There are just not enough wealthy people to fund their privileges.

Democrats in Washington are well aware of this, which is why they are using budget gimmicks to hide $5 trillion in expenditures over a 10-year period. They propose to pay for a few years of expenditure by raising taxes on companies and the wealthy for ten years, but this would only bring in $2.1 trillion in additional income.

Because of Europe’s massive pensions, there is less money available for security and the military. Only nine European nations fulfill their NATO commitment to spend 2% or more of GDP on defense, and only Greece spends more than 3%, as does the United States. Germany spends just 1.56 percent of its GDP.

In the 1980s, the United States was able to destroy the Soviet empire because to a growing economy that generated enough money to rebuild the military. Mr. Biden wants to cut military spending in real terms, and his welfare-spending wedge will widen quickly. As China grows, there will be no Reagan-style military buildup.

***

Ironically, several European governments have attempted to alter their tax and welfare systems in order to improve their competitiveness. Over the course of two decades, Germany and Sweden have changed their welfare and labor systems. They have outperformed the rest of Europe in terms of labor participation and GDP growth. Germany’s workforce participation rate increased from 58.1 percent in 2000 to 61.3 percent in 2019.

Sweden’s tax burden grew to the highest in the world throughout the 1970s and 1980s as its social system became considerably more generous. As a consequence, after-tax real earnings in Sweden remained stagnant while government debt grew. Sweden’s GDP growth was approximately half that of developed nations and a third that of Europe’s major economies from 1976 to 1995.

In the early 1990s, Sweden’s economic downturn spurred tax and expenditure changes that improved labor productivity, private job growth, and wages. Between 1996 and 2011, the pace of growth in disposable income quadrupled. From 2010 to 2019, Sweden’s average GDP growth rate of 2.6 percent outpaced that of other European nations.

Other European countries are pressing for welfare changes as well. Emmanuel Macron, the French president, has approved pension reform and reduced the corporation tax rate to 26.5 percent from 33 percent in 2017, with smaller businesses paying 15 percent. With Prime Minister Kyriakos Mitsotakis’ tax, pension, and regulatory reforms, Greece is breaking free from its financial prison. Mr. Biden wants to raise America’s total federal-state average far over 30%. The business rate is now 22%.

Mr. Biden also said on Tuesday that the United States needed to invest more in renewable energy and manufacturing in order to compete with China. However, Beijing’s industrial strategy has resulted in capital misallocation and economic distortions, as shown by the country’s present debt problems. When did China become a role model for the rest of the world?

America was able to reverse its downward spiral in the 1970s by reverting to its traditional paradigm of encouraging individual initiative and entrepreneurship. Mr. Biden’s proposal would give the government more authority, place more costs on the private sector, and reduce upward mobility by encouraging individuals to stay at home. That is the true formula for failure.

“We’ve got three things to accomplish,” Joe Biden said of Wonderland. “The debt limit, the continuing resolution, and the two bills are all on the table. If we accomplish that, the nation will be in excellent condition.” Images courtesy of Disney/Getty Images/Everett Collection Mark Kelly’s composite

Dow Jones & Company, Inc. All Rights Reserved. Copyright 2021 Dow Jones & Company, Inc. 87990cbe856818d5eddac44c7b1cdeb8

The entitlements of U.S. decline is a title that is used to describe the United States’ declining economic and military power. Reference: entitlements government.

Related Tags

- entitlement expansion

- wall street journal opinion editor

- wsj commentary

- in biden’s america everyone is entitled to everything

- family entitlement